Net Sales: What They Are and How to Calculate Them

August 13, 2024

Gross revenue represents the total income generated by a business, while sales refer to the revenue generated from selling products or services. In contrast, net sales are the total revenue of a company after the deduction of returns, discounts, and allowances. Instead, they show the pure profit of a company over a given period of time. Nevertheless, analysts often find it helpful to plot gross sales, net sales, and the difference between both figures to determine how each value trends over a period. If the difference between gross and net sales increases over time, this could indicate trouble with product quality.

Get a full visual of your business in an instant

- These include wage garnishment, union dues, and other benefits you choose to participate in through your employer.

- If your POS dashboard includes discounts and allowances, it might already calculate net sales for you, so you’ll need to figure that out on your own.

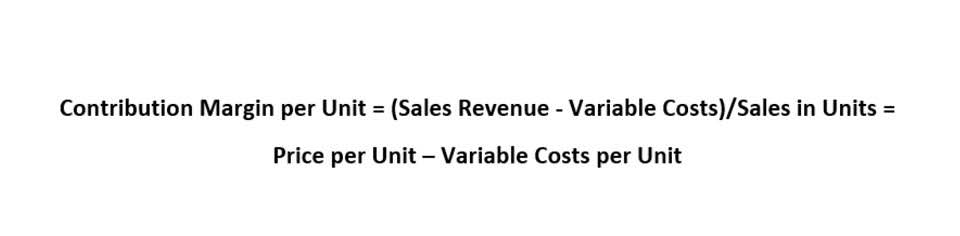

- Net sales are calculated by deducting sales allowances, sales discounts, and sales returns from gross sales.

- Let’s go back to our $50,000 in gross sales a month example from before.

- So the discount is only offered at the time of receipt of cash from customers.

- Additionally, 200 full-price shoes were returned, and 100 discounted shoes were returned.

On the other hand, profit is the net revenue you get after deducting all expenses that cost your company for production and selling. In general, net sales reflect your company’s sales performance, while profit shows its financial health. Gross revenue (also known as total revenue or gross income) is the total amount of money generated by the sale of goods or services over a period of time, such as a quarter or a year.

Understanding the gross sales formula

If the discrepancy between the two figures is substantial or consistently growing, there may be issues or deficiencies with the product, making for considerable amounts of returns or allowances. When Casey calculated her net sales, she included allowances for customers who bought defective items. Last year, there were only two customers who demanded a discount of 50% on damaged sweaters, so she included an allowance of $35 (2 x $17.50) in her gross sales report. Casey also factored in a 25% coupon code redeemed by 20% of her customers.

How gross revenue and net revenue impact financing

- The three specific types of deductions as mentioned above are – discounts, returns and allowances.

- Among all the responsibilities you have as an entrepreneur, tracking your company’s gross and net sales might fall off your plate — and that’s where Streak comes into play.

- That’s why it isn’t enough to run a gross sales analysis against your competitors.

- Net income or net sales is sightly more complicated to calculate, as you need to know all of the deductions that have been applied to your sales.

- Compare your own figures with competitors to see how you’re performing in the marketplace and identify new opportunities and areas of improvement in your existing sales processes.

- Unless you offer tremendously specified goods or services, it’s always a balancing act.

Everyone wants one, and their sales team is working hard to meet that demand. Revenue Intelligence also offers sales insights in several forms, directly from the dashboard. Easy-to-understand visuals clearly illustrate sales and forecast trends so you’ll never be in the dark. Salesforce’s Revenue Intelligence highlights opportunities and risks that you may otherwise miss. It uses AI to analyze customer data and measure progress towards meeting sales goals.

- Net pay is your take-home pay—the money you get after taking all deductions from your gross pay.

- As part of that, we recommend products and services for their success.

- A store with a small gap doesn’t have to have very many sales in order to draw customers and has a low return rate.

- Say the operations at the Battery Operated Light Up Hooting Owl Pest Deterrent factory ground to a halt, and the company wound up shipping one of its products to a buyer a month late.

- Fortunately, high-quality accounting software makes the calculations a breeze.

- It is derived from the gross figure which is the total income a company earns during a specific period.

The terms gross and net are used frequently in accounting and finance conversations. The easiest way to know what someone means is to think about what could naturally be deducted from something. Download CFI’s Excel calculator to input your own numbers and calculate different values on your own. As you’ll see in the file, you can easily change the numbers or add/remove rows to change the items that are included in the calculation.

Sales Allowances

However, in spite of its product’s popularity, Battery Operated Light Up Hooting Owl Pest Deterrent LLC needs that money as soon as possible. In this case, the company might offer the retailer a 2% discount for paying off the invoice sooner. Here, we’ll take some time to understand what gross and net sales are, what differentiates the two from one another, and what they can show about the health of a business. Net sales are much more relevant in decision making than gross sales. The give a better picture of the current financial position of a company.

Free templates to track sales

Net sales provides a complete idea of how much a business spends and earns through the sales process. They are key figures that financial analysts use to understand the overall financial health and business income. The difference between gross sales and net sales can also be a valuable indicator of the quality of a company’s product or service.

This is where reviewing net sales alongside gross sales comes in handy. Let’s take a look at some of the benefits that come with understanding and analyzing your gross and net sales. From damaged gross sales vs net sales goods to late deliveries, customers can decide to send the product back for a variety of reasons, and as long as they’re in line with your return agreement, they can request a refund.

Recent Comments