Profit Definition Plus Gross, Operating, and Net Profit Explained

August 13, 2024

the gross profit does not take into account: does not account for debt expenses, taxes, or other expenses required to run the company. The gross profit formula is used to calculate the gross profit by subtracting the cost of goods sold from revenue. Revenue equals the total sales, and the cost of goods sold includes all of the costs needed to make the product you’re selling.

Do you own a business?

A gross income amount is reported on a company’s profit-and-loss statement and is typically a standardized calculation for businesses in the same industry. You can find a company’s gross profit by looking at its latest income statement, which is one of the three major kinds of financial statements that a company will produce. For example, Apple (AAPL) had 31.6% gross margins on product sales in 2019, but 64% on its services business.

Reduce material costs

Non-operating items are those that are not related to the primary operations of a company. This can consist of utilities, rent, property taxes, salaries or wages, and business travel expenses. In a competitive market, neither of the above options may be available to you. You might not be able to change your top line much, but maximizing your gross profit might give you a distinct advantage over your competition.

Comparison With Industry Averages

- Improving gross margin can be done by increasing sales price, reducing costs of goods sold, and improving product or service design.

- Gross profit margin, on the other hand, is this profit expressed as a percentage.

- Gross profit helps a company analyze its performance without including administrative or operating costs.

- COGS, as used in the gross profit calculation, mainly includes variable costs, which are the costs that fluctuate depending on the output of production.

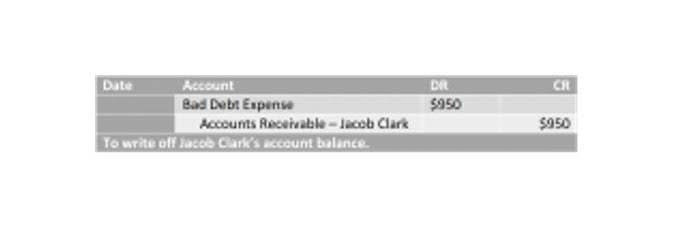

These are fixed costs and, as such, aren’t included in the gross profit formula. Gross profit calculates the gross profit margin, a metric that evaluates a company’s production efficiency over time. It measures how much money is earned from sales after subtracting COGS, showing the profit earned on each dollar of sales. Comparing gross profits year to year or quarter to quarter can be misleading since gross profits can rise while gross margins fall. Gross profit is calculated on a company’s income statement by subtracting the cost of goods sold (COGS) from total revenue. It’s important to note that gross profit differs from operating profit, which is calculated by subtracting operating expenses from gross profit.

- Calculate gross margin to understand your business’s current finances better and make wise financial decisions in the future.

- Gross profit helps to show how efficient a company is at generating profit from producing its goods and services.

- In this case, the company would need to strategically raise prices while also working on improving its product offering.

- Gross profit is important because it tells us how efficient a company is in its production and selling process.

- Gross profit is a standard financial reportingmetric on a company’s income statement.

- A company’s gross margin should be compared against industry averages to benchmark performance and identify areas for improvement.

- The same goes for other variable costs such as packaging and other ingredients you need to make your product.

What Is a Good Gross Profit Margin?

This implies that the services business is more profitable for each dollar of revenue. Gross income or gross profit represents the revenue remaining after the costs of production have been subtracted from revenue. Gross income provides insight into how effectively a company generates profit from its production process and sales initiatives. However, when calculating operating profit, the company’s operating expenses are subtracted from gross profit.

Some analysts are interested in top-line profitability, whereas others are interested in profitability before taxes and other expenses. Still others are only concerned with profitability after all expenses have been paid. Any profits earned funnel back to business owners, who choose to either pocket the cash, distribute it to shareholders as dividends, or reinvest it back into the business. Gross profit is a good indicator of a company’s profitability, but it is important to understand its limitations. A company can get discounts by purchasing in bulk the raw materials from the suppliers.

How to Calculate Gross Profit Margin

Recent Comments